Sustainability Reporting Practices in Indian Mining Companies

Daizy 1 * and Niladri Das1

Corresponding author Email: jassal1986@yahoo.com

DOI: http://dx.doi.org/10.12944/CWE.10.2.30

Nowadays sustainability reporting can be used for communication purpose in marketing and to show transparency of the company (Kolk, 2000). These types of reports published by organization to disclosed more information on non-financial performance. These report highlighted the company’s commitment towards stakeholders. Various industries throughout the world started disclosing non-financial performance (sustainability reporting) by using various different types of frameworks like Dow Jones index or global Reporting Initiative. In the 21st century sustainability reporting becomes important but in India it’s still in nascent stage. Out of all industries mining should be disclose information on the non-financial performance because of put direct negative impact on society and environment. Moreover mining is considered as one of the most polluting industries in the world. The objective of this paper is to examine and compare the level of sustainability reporting of sample private mining companies and sample public mining companies as GRI framework. It involves an explorative research design to understand the trend and variation in the quality and extent of sustainability disclosure information by top 100 Indian mining companies.

This study uses the content analysis methodology for analyzing annual reports, websites and stands alone reports of top 100 mining companies as per net sales have been studied for 2007-2012 and sustainability disclosure index to analysis the extent and quality of sustainability reporting as per GRI in India. Moreover, independent t-test and simple t-test have been used to compare the disclosure practices between and within the sample private and public mining. The results of the analysis show that there are significant variations in sustainability disclosure practices as per GRI framework within and between the public and private mining companies. The study revealed that sustainability reporting disclosure practices are more in public sector as compared to the private sector mining companies. The study observed that sustainability disclosure by public mining companies are more as compared to the private mining companies but as far as content quality is concerned private mining companies disclosed limited but relevant information on sustainability disclosure as per GRI.

Copy the following to cite this article:

Daizy, Das N. Sustainability Reporting Practices in Indian Mining Companies. Curr World Environ 2015;10(2) DOI:http://dx.doi.org/10.12944/CWE.10.2.30

Copy the following to cite this URL:

Daizy, Das N. Sustainability Reporting Practices in Indian Mining Companies. Curr World Environ 2015;10(2). Available from: http://www.cwejournal.org/?p=11429

Download article (pdf) Citation Manager Publish History

Select type of program for download

| Endnote EndNote format (Mac & Win) | |

| Reference Manager Ris format (Win only) | |

| Procite Ris format (Win only) | |

| Medlars Format | |

| RefWorks Format RefWorks format (Mac & Win) | |

| BibTex Format BibTex format (Mac & Win) |

Article Publishing History

| Received: | 2015-05-06 |

|---|---|

| Accepted: | 2015-06-19 |

Introduction

Sustainability reporting is not limited to any specific country and is followed in both developed and developing countries. Over 80 percent of companies worldwide now publish sustainability reports (KPMG, 2008) and more than half of the world’s 250 largest companies issue sustainability reports (White, 2005). As a result, considerable research work has been devoted to examine the reason for their development and their relevance to improving their accountability towards the stakeholders (Deegan 2002; Unerman et al. 2007; adams, 2004; Gilbert and Rasche,2007; Owen et al,2000). Majority of the literature of sustainability aims to achieve an integration of economic, social and environmental aspects of corporate houses. Nowadays, stakeholders are interested to obtain further information on the impact of corporate activities (O’Dwyer et al., 2005). This information reflects a simultaneous integration of sustainability aspects in the corporate behavior with the aim of sustaining resources for future generations (e.g., Eppel, 1999). Sustainability reporting gives users a more transparent view of the company, potentially enabling them to make more informed decisions while building trust (Mock et al., 2007). But in contrary to above statement for many corporate houses, sustainability reporting is an extension to the corporate reporting (Milne and Gray, 2007). Basically sustainability reporting is to satisfy the request of the diverse group of stakeholders with the motive of profit maximization (Lopez et al, 2007).

Hubbord, 2008 incited in his research that those organizations that are producing sustainability reports are more concern about environmental and social issues. Therefore, organizations and investors recognize that investing in accordance with sustainability principle has the capacity to create long term value (Bebbington, 2001). But still sustainability reporting is treated as a vague concept and non-financial issues such as economic, environmental and social , ought to be considered together. The relationship among the environment, society and environment with industrial activities are an integral part to the concept of sustainability development and have to be balanced. In this context the term triple bottom line is very common in as optimal manner. This relationship is also seen as a strong source of competitive advantage, as it can lead to more efficient processes, improvements in productivity and sustain business in future (Schaltegger and Wagner, 2006).

Hence in nutshell corporate sustainability reporting has different meaning for different persons. Corporate sustainability reporting is often found that it is interchangeably used with terms such as “corporate social responsibility”, or sustainable development but each term has a separate meaning and has its own importance in business management. Sustainability reporting is voluntarily reporting and reporting rate are very high in developed countries like Germany , France, Japan and highest in certain industries like chemical and synthetics, pharmaceuticals, electronic and so on (Choi,2006). Some studies were found on comparison but they exclusively concentrated within the developed and developing countries or between developed countries (Streuer & Konard, 2009). The researcher has not come across any study that has compared the sustainability reporting in public and private mining sector.

Objective of Study

Against this background, an attempt has been made to understand the future of sustainability reporting as per GRI framework in Indian mining sector. The objective of this paper is to study the future of sustainability reporting as per GRI guidelines in Indian mining sector.

Sustainability reporting is a process which is used to disclose the non-financial performance of the corporate house towards their stakeholders. These reports set standards in assessing the sustainability performance with respect to laws, norms, codes, performance standards and voluntary initiatives. Out of these various initiatives, the most comprehensive recognized and referenced framework currently in use is provided by the Global Reporting Initiative (GRI), which is discussed in detail in the next section.

Framework and Principles of Sustainability Reporting

GRI sustainability Reporting Framework provides guidance on how organization can disclose their sustainability performance. The basic aim of the GRI is to strengthen the rigor and transparency of sustainability reporting by providing balanced and reasonable representation of sustainability performance of a reporting organization (GRI, 2006 p3). To achieve this goal, GRI has some specific indicators for various industries and principles: materiality, stakeholder inclusiveness, sustainability context, completeness balance, clarity, comparability, reliability etc.

GRI guidelines categorizes the various indicators in to three parts such as economic (9 indicators), social (45 indicators) and environment (30 indicators). The application of these indicators is being verified through a process of external assurances (KPMG,2008). At present, GRI is considered de facto standard for sustainability reporting because it provides a metric that can be used by any organization of any size.

In India, companies have been reporting on sustainability since 2001 by using the GRI Framework, following the Carbon Disclosure Project (CPD) or completing the UN Global Compacts Communication of Progress (Cop). In India, it is not mandatory but voluntary to report on sustainability issues. Government of India in 2011 released Voluntarily Guidelines on social, Environmental and Economic Responsibilities of Business (NVGs). NVGs (National Voluntarily Guidelines ) constitute of 9 “ core Principles” of different aspects of Business Responsibility and 48 “Core Elements”, which are included alongside the core principles to help guide business in adopting/integrating the NVGs in to their operations (NVGs, 2011). Basically Indian companies have disclosed information on environmental aspects. A Gazette Notification on Environmental Audit has been issued by the Ministry of Environment Statement by the companies to the pollution Control Board (PCB) (Sen M et. al, 2011). Based on survey of (KPMG,2011) has shown 95% of the 250 largest global companies (G250) now issue sustainability reports, representing a 14% jump over its previous survey conducted in 2008.

Core sector is considered as one of the most polluting and is under public and government pressure to disclosed sustainability information. Mining operations frequently involve a high degree of environmental impacts and categorized under Red category according to Indian ministry of forest and environment. Thus focus of this paper is to study the existing status of voluntary sustainability disclosure in Indian mining sector as per Global Reporting Initiatives (GRI).

Belal(2001) incited his study that 97% companies of Bangladesh had made descriptive disclosure . However, quality of disclosure was very less.( Simnett et al. 2009b, Kolk 2008) incited that more than 30% issued a stand-alone sustainability report as per Global Reporting Initiatives, of which more than 50% contain an assurance statement In India only 80 companies disclosed information on sustainability aspect as per Global Reporting Initiatives (GIZ,2012). These 80 companies are mainly from other sectors (telecom, financial services , FMCG etc) that has lead the development of the sustainability reporting and pointing out that this form of reporting is a big challenges for corporate houses (KPMG,2008; Epstein,2008). As a result Indian public sector lagged behind but they are also disclosing information as per National Voluntary Guidelines, sector supplement for public agencies, centre for public agency sustainability reporting (CPASS) and so on. It is quite surprising that the GRI encourages organizations to use the framework as basis for sustainability reporting but Guthrie and Farneti (2008) found that these public sectors were reporting as per GRI guidelines but patterning of disclosure is as per the organization interest. That’s mean public sector chose only some of the GRI indicators to disclose as per their wish.

Prior literature observed framework and trends of sustainability reporting as per Global Reporting Initiatives in developed and developing countries. It revealed that sustainability reporting is becoming buzzing word in every sector but still mining sector is far behind to disclose information on the non-financial performances to their stakeholders. There is variation in the reporting system of sustainability aspect in public and private sector. That’s mean, not much work has been done to explore the sector-wise comparison. So, present study’s attempt to fulfill the gap of private and public sector comparison by comparing Indian private mining and public mining sector.

Research Methodology

This is an exploratory research design to understand the trend and variation in the quality and extent of sustainability reporting by public and private Indian mining companies. The unit of analysis is ‘company’. GRI guidelines are taken as a basis for analysis. For the purpose of current research data from top 100 Indian mining companies as per Net Sales are taken from Indian corporate Database “capital line” of capital market for the financial year 2007-2012. A sample of 53 private companies and 47 public companies were selected for the purpose. Annual Reports, Websites and sustainability reports published by the selected companies during this (2007-2012) period was considered for the analysis. This study used content analysis methodology to assess the extent and quality of sustainability reporting disclosure as per GRI guidelines in the Indian mining sector.

Content analysis involves systematic procedures for studying the content from the written documents (Halme and Huse, 1997). This study uses a “number of sentences” as a recording unit for the purpose of content analysis. Number of sentences has been used in the previous empirical studies like (Hackston and Milne.1996; Milne and Adler, 1999; Holland and Foo , 2003; Chatterjee and Mir, 2008). They considered number of sentences as the most appropriate measure of disclosure, as well as a sound basis for coding and analysis. Content analysis is done on the basis of GRI guidelines related to the environment, social and economic aspects of the organization. A total of 84 indicators (which consists 30 indicators for environment, 45 indicator of social and 9 indicator of economic aspects) have been taken for this study incited in the website https://www.globalreporting.org/Pages/default.aspx.

Comparative analysis has been used to examine the level of sustainability reporting of private and public mining companies in India as per GRI framework. The content analysis method used in the present study involves the following process (i) indentifying information as per GRI framework, (ii) assigning score and determining the aggregate score for each firm.

- Indentifying information as per GRI framework: - This step involves classifying information as per GRI framework disclosure grid. For this we adopted Global Reporting Initiative framework, which constitute 85 indicators broadly classified in to three main categories i.e. environmental (30), social (45) and economic (9).

- Assigning a score and determining the aggregate score:- For this purpose of analysis of the sustainable development reports content analysis was applied taking disclosure index as per GRI guidelines. It constitutes 84 indicators with maximum score of 2 each (as 2 for full disclosure: - if information completely disclosed as per GRI guidelines, 1 for partial disclosure: if information is disclosed but not disclosed completely as per GRI guidelines and 0 for no disclosure) making total possible score 168 (84*2).

- Further, independent sample t test and correlation were applied to judge the significant difference between means of two groups, that is, public and private Indian mining companies.

- The extent of disclosure of all companies has been measured separately.

- A comparison has been made regarding variation in disclosure of public and private mining companies.

Results

The results and discussion have been categorized in two parts. In the first part, the extent of sustainability disclosure of companies has been explored and the second part deals with comparison of sustainability disclosure in public and Private Indian mining companies has been examined with the help of disclosure score using content analysis techniques. Information collected manually from the annual reports, websites and sustainability or standalone report were clarified as per GRI indicators and then scores were assigned depicted which is accessible in appendix1 (GRI indicators).

Private Companies Sustainability Disclosure

The sample of private mining companies’ disclosure is exhibited in table no 1. The disclosure score of the items varies from 82 to 0. In private companies it is revealed that Sesa Goa has obtained first rank with the percentage score of 48.81% which is below 50%. This result showed that Indian mining companies are still not very serious in disclosing sustainability reporting practices in their annual reports. Moreover out of 53 sample companies only 18 private companies disclose information as per GRI framework covering very few indicators. There is a huge variation between the sustainability disclosure practices of India private mining companies. Majority of companies provides no information at all regarding sustainable management practices and if at all it provides some information it is only partial.

|

Table 1: Sustainability Disclosure As Per Indian Private Mining Companies Click here to View table |

Public companies –wise sustainability disclosure

In this section, sustainability disclosures of sample public Indian mining companies have been depicted that is accessible in exhibited 2. The sustainability disclosure score in public companies varies from 48 to 0. The disclosure item score showed that National Mineral Development Corporation (NMDC) ranked first with the percentage score 28.57 % only. Only 23 public mining companies disclosed information on the non-financial aspects. The volume of disclosure varies from neutral followed by partial and then full information. It observed that in public companies also disclosure is below 50% but the numbers of companies are more as compared to private mining companies.

|

Table 2: Sustainability Disclosure As Per Indian Public Mining Companies Click here to View table |

Sector –Wise Variation in Disclosure

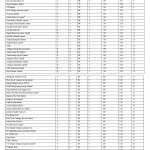

Companies have been divided in two parts as depicted in table no. 3.

|

Table 3: Private And Public Mining Companies Of Sustainability Disclosure Click here to View table |

To study the variation in the disclosure practices we developed the null hypothesis:-

Public sector mining companies H02 - There is no significant difference between disclosure score of different public mining companies.

H01 – There is no Significant Difference Between Disclosure Score of Different Private Mining Companies

Result

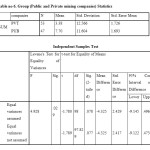

It can be observed from table no: 4, that p value is less than 0.005 , hence the null hypothesis H01 is rejected. Hence it revealed that there is high variation in the disclosure practices of the Indian private sector mining companies.

Table 4: Results of one-sample t-test (Private Indian mining companies) One-Sample Test

|

One-Sample Test |

||||||

|

Test Value = 30 |

||||||

|

t |

df |

Sig. (2-tailed) |

Mean Difference |

95% Confidence Interval of the Difference |

||

|

Lower |

Upper |

|||||

|

S |

-15.424 |

52 |

.000 |

-26.623 |

-30.09 |

-23.16 |

H02 - There is No Significant Difference Between Disclosure Score of Different Public Mining Companies.

Result

It can be observed from table no: 5 that value of p is less than 0.005, hence the null hypothesis H02 is rejected. Hence it revealed that there is high variation in the disclosure practices of the Indian public sector mining companies.

Table 5: Results of one-sample t-test (Public Indian mining companies One-Sample Test

|

One-Sample Test |

||||||

|

Test Value = 24 |

||||||

|

t |

df |

Sig. (2-tailed) |

Mean Difference |

95% Confidence Interval of the Difference |

||

|

Lower |

Upper |

|||||

|

V8 |

-9.629 |

46 |

.000 |

-16.298 |

-19.70 |

-12.89 |

Comparison of Sustainability Disclosure in the Public and Private Sector Mining Companies Group –Wise Disclosure

To calculate the significant difference between means of two groups’ [Group 1- private mining companies, Group 2- Public mining companies] independent t-test was applied. The hypothesis is -

H1 – There is Significant Difference Between Disclosure Score of Private Sector Mining Companies and Public Sector Mining Companies.

Table no: 6 shows that the alternatives hypothesis, i.e., there is significant difference between the mean scores of public and private sectors mining companies p value is greater than the 0.05 depicts that there is significance difference in the disclosure practices of public and private sector. Hence hypothesis is accepted.

|

Table 6: Group (Public and Private mining companies)Statistics Click here to View table |

From the above analysis it is clear that the mean of public sector Indian mining companies that is 7.70 which is more than private mining sector companies which has a mean score of 3.38. It signifies that sustainability disclosure by public companies is more than private sector mining companies.

Discussion

Sustainability reporting is in its nascent stage in Indian mining sector, but it is an effective communicating tool for sustainable management practices between the company and the interested stakeholders. It has been observed that disclosure practices that are followed varies across different sectors. Public sector mining companies are disclosing more and more information on the aspect of the sustainability but they are using only the national framework for reporting purpose which is the national voluntarily guidelines or national mineral policy sustainable development framework. These frameworks have several limitations. However the history of sustainability reporting as per Global reporting Initiative framework is very new in the Indian mining sector. No public sector mining companies are disclosing information as per GRI guidelines. In fact they are showing numerous information’s as per their convenience and is not adopted any uniform guidelines. On the other hand, private sector mining companies are showing very less information’s as per sustainability practices. Only Sesa Goa Ltd has presented their sustainability reporting as per GRI framework. The study revealed that sustainability reporting disclosure practices are more in public sector as compared to the private sector mining companies. This study observed that sustainability disclosure by public mining companies are more as compared to the private mining companies but as far as content quality is concerned private mining companies disclosed limited but relevant information on sustainability disclosure as per GRI. However there is huge variation in information disclosure as per GRI guidelines in both the sector which is exhibited in the table no.8.

Table 7: Comparison Between Private And Public Mining Companies Sustainability Disclosure

|

NAME OF PRIVATE COMPANIES |

S |

RANK |

NAME OF PUBLIC COMPANIES |

S |

RANK |

|

Sesa Goa Limited |

82 |

1 |

National Mineral Development Corporation |

48 |

1 |

|

MSPL |

43 |

2 |

Eastern Coalfields Limited (ECL) |

36 |

2 |

|

NLCPL (national Limestone Company Private Limited |

7 |

3 |

central coalfield ltd |

31 |

3 |

|

Deccan Gold Mines Ltd |

6 |

4 |

Coal India Ltd |

29 |

4 |

|

Harsha Engineer limited |

5 |

5 |

Mahnadi coalfield Limited |

26 |

5 |

|

STP limited |

5 |

6 |

South Eastern Coalfield limited |

24 |

6 |

|

Essel Mining industries limited |

5 |

7 |

Singareni Colliery limited |

18 |

7 |

|

20 micron limited |

4 |

8 |

Western Coalfield Limited |

18 |

8 |

|

Madhu Silica pvt Limited |

4 |

9 |

KIOCL |

17 |

9 |

|

Parsa Kente Collieries Limited |

4 |

10 |

MOIL |

17 |

10 |

|

Resurgee Mines Mineral Limited |

4 |

11 |

Uranium Corporation of India limited |

16 |

11 |

|

bhaskar shrachi alloys limited |

3 |

12 |

Bharat Coking Coal Limited(BCCL) |

15 |

12 |

|

Auroma Coke Ltd |

2 |

13 |

Gujrat Mineral Development Corporation |

15 |

13 |

|

Bengal Emta Coal mines Limited |

1 |

14 |

Orissa Mineral Development Company Ltd |

14 |

14 |

|

kachchh Minerals Limited |

1 |

15 |

Miineral Exploration Corporation Limited |

9 |

15 |

|

Mineral Enterprises limited |

1 |

16 |

the Sandur Manganese and Iron ores limited |

6 |

16 |

|

Rungta Projects Limted |

1 |

17 |

Bharat Gold mine ltd |

5 |

17 |

|

JCBL |

1 |

18 |

Jammu &Kashmir Mineral Development Limited |

4 |

18 |

|

Abhijeet Mining Private Limited |

0 |

19 |

Northern Coalfield limited |

4 |

19 |

|

Adani Mining Pvt Limited |

0 |

20 |

Broda Extrusion limited |

3 |

20 |

|

Anshul impex private Limited |

0 |

21 |

Shirpur Gold refinery limited |

3 |

21 |

|

Ashapura Clayte Limited |

0 |

22 |

Saurashtra Calcine Bauxite Allied Industries Ltd |

2 |

22 |

|

Ashapura international limited |

0 |

23 |

SVC resources limited |

2 |

23 |

|

Ashapura Minechem Limited |

0 |

24 |

Birsa Stone Lime company Limited |

0 |

24 |

|

AXL Exploration limited |

0 |

25 |

Bombay Mineral Ltd |

0 |

25 |

|

Best Minerals Limited |

0 |

26 |

Burrakur Coal company Limited |

0 |

27 |

|

Chendipada Colleries Pvt ltd |

0 |

27 |

coromandel stampings stones limited |

0 |

27 |

|

Chowgule & company private limited |

0 |

28 |

Eastern Mining and allied Industries |

0 |

28 |

|

Deepak Mining Services Pvt Ltd |

0 |

29 |

FCI Aravali Gypsum & Mineral Limited |

0 |

29 |

|

GMR Mining energy private Limited |

0 |

30 |

GKN Sinter Metal Limited |

0 |

30 |

|

Gupta Domestic fuel (nagpur) Ltd |

0 |

31 |

HGML (Hutti gold mine Company Ltd) |

0 |

31 |

|

India Tube Mills and metal industries Limited |

0 |

32 |

Himdari Chemical industries limited |

0 |

32 |

|

Kanyaka Fine Weld limited |

0 |

33 |

hindustan colas limited |

0 |

33 |

|

karanpura development |

0 |

34 |

Hindustan minerals product company limited |

0 |

34 |

|

Light Roofing limited |

0 |

35 |

indian metals & carbide limited |

0 |

35 |

|

Lucky Minmat Limited |

0 |

36 |

indophil Resources |

0 |

36 |

|

Maytas Mineral Resource limited |

0 |

37 |

Madhya Pradesh Jaypee Mine Limited |

0 |

37 |

|

pandian Graphite India Ltd |

0 |

38 |

Meghalaya Mineral Mines Limited |

0 |

38 |

|

Pure Kenda Coal |

0 |

39 |

Rashtriya Metal industries limited |

0 |

39 |

|

Ruby Mica Company Private Limited |

0 |

40 |

South west Drilling Infrastructure limited |

0 |

40 |

|

rungta Mines Limited |

0 |

41 |

tamil Naidu Magnesite ltd |

0 |

41 |

|

Sesa Resources Limited |

0 |

42 |

Sri Subramanya mines mineral ltd |

0 |

42 |

|

Sree Maruthi Marines industries Ltd |

0 |

43 |

Sri Swaminatha mines mineral Limited |

0 |

43 |

|

Sri Shanmugha mines and mineral limited |

0 |

44 |

Stone & Mineral associates limited |

0 |

44 |

|

ST -BSES Coal |

0 |

45 |

Rajas states Mines and Mineral Limited |

0 |

45 |

|

Sunta Stone |

0 |

46 |

JMC Mining quarries Limited |

0 |

46 |

|

Tiffin's Barytes |

0 |

47 |

quality Minerals Limited |

0 |

47 |

|

V.S. Dempo Mining Corporation Limited |

0 |

48 |

|||

|

Wolkmen India |

0 |

49 |

|||

|

Hy grade Pellets limited (essar group) |

0 |

50 |

|||

|

New Beerbhoom Coal Company Limited |

0 |

51 |

|||

|

orissa manganese & mineral limited |

0 |

52 |

|||

|

Valley Magnesite private Limted |

0 |

53 |

This paper incited that sustainability reporting has many positive implications because better reporting helps to increase quality of decision making. Sustainability reporting has a large potential for raising environmental and social concern to the processes of organizations. In relation to good governance (that is, the transparency of institutions and processes), sustainability reporting has much to offer for both the private and public sectors. Sustainability reporting can thus help to increase the effectiveness of mining sector governance.

Conclusion

This paper reveals that disclosure of the non-financial performances’ has significant impact on the sustainability of the company in the future. The impact of sustainability reporting will help the company in maintaining their goodwill in the society in which it operates. Therefore to minimize the hazardous impact of the mining activities on the society there is need for compulsory regulation which are required in terms of sustainability disclosure practices in proper format as per GRI guidelines. The initiatives of Global Reporting are expected to improve sustainability disclosure in the near future. This study contributes to understand the sustainability reporting disclosure practices in Indian public and private sector mining companies. The company analysis reveal that number of sustainability reports is more popular in public sector but as far as the content of disclosure i.e. quality and quantity of the information is concerned Indian private sector mining companies provides more information as per GRI framework.

References

- KPMG(2008), “international survey of corporate reporting 2008”, retrieved from http://www.kpmg.com/EU/en/Documents/KPMG_International_survey_Corporate_responsibility_Survey_Reporting_2008.pdf , accessed on 23 dec 2014.

- White G. and B Fall. , Management Accounting Quarterly,7 (2005).

- Deegan C., Accounting, Auditing & Accountability Journal, 15, 282-311 (2002).

- Unerman J., Bebbington J. , and O’Dwyer B. , Sustainability , Accounting and Accountability New York, NY (2007).

- Adams C. A., Accounting Auditing &Accountability , 17, 731-757 (2004).

- Gilbert D.U. and Rasche A., Journal of Business Ethics, 82, 755-773 (2007).

- Owen D., Swift T., Humphrey C. and Bowerman M. , European Accounting Review ., 9, 81-98 (2000).

- O'Dwyer, B., Unerman, J. and Hession, E., European Accounting Review, 14,759-787 (2005).

- Eppel, J. Development and Sustainability 41-53 (1999).

- Mock, T.J., Strohm, C. and Swartz, K.M., Australian Accounting Review, 17, 67-74(2007).

- Milne, M. J and Gray, R, , sustainability accounting and accountability , routledge, London (2007).

- Lopez, Victoria M, Garcia A, and Rodriguez L, Journal of Business Ethics, 7, 285-300(2007).

- Hubbord G, December 15” beyond accounting-assessing the impact of sustainability reporting on tomarrow’s business”, retrieved from http://www.icaew.com/~/media/Files/Technical/Sustainability/graham-hubbard-sustainability-reporting-discussion.pdf A discussion paper, Adelaide, Australia, accessed on 10-05-2013 (2008).

- Bebbington, J., Gray, R., Hibbitt, C. and Kirk, E., Full Cost Accounting: An Agenda for Action (London: Certified Accountants Educational Trust). Available for download at accessed 5 January 2008 (2001).

- Schaltegger ,stakeholder-Beziehungen and reputation in baslerzeirung, 3rd march, 2003,15 (2006).

- Choi, Frederick D.S., and Gary K M, international Accounting, 6th edition, New Jersey: Pearson Prentice Hall (2008).

- Steurer, R. and Konard, A.Scandinavan Journal of Management. Vol.25, 23–36 (2009).

- 'Sustainability Reporting Guidelines: Version 3.0', New York: Collaborating Centre of the United Nations Environment Programme (2006).

- Global Reporting Initiative (GRI. “Sustainability reporting G3 guidelines”, Retrieved from http://www.globalreporting.org/NR/rdonlyres/ED9E9B36-AB54-4DE1-BFF2-5F735235CA44/0/G3_GuidelinesENU.pdf accessed on 1/05/2015 (2006).

- KPMG(2008), “international survey of corporate reporting 2008”, retrieved from http://www.kpmg.com/EU/en/Documents/KPMG_International_survey_Corporate_responsibility_Survey_Reporting_2008.pdf , accessed on 23 dec 2014. http://www.mca.gov.in/Ministry/latestnews/National_Voluntary_Guidelines_201112jul 2011. pdf accessed on 26/04/2015(20011).

- Sen M, Mukherjee K. et al . Journal of Applied Accounting Research. Vol. 12. 139-156 (2011).

- KPMG 2011.international Survey of Corporate Responsibility Reporting. online from http://www.kpmg.com/PT/pt/IssuesAndInsights/Documents/corporate-responsibility2011.pdf . [24 july 2014].

- Belal, A.R. Managerial Auditing Journal 16, 274-89 (2001).

- Simnett, R., Vanstraelen, A., & Wai Fong, C. Accounting Review, 84(3), 937-367 (2009).

- Corporate Sustainability Reporting Trend in India retreieved from www.giz.de/en/downloads/giz-2012-sustainable-reporting-india-en.pdf acessed on 2014.(2012)

- Guenther E et al . Greener Management International . Vol 53. Pp. 7–25 (2006).

- Hackston, D. and Milne, M. Accounting ,Auditing and Accountability Journal, Vol. 9. 51-61(1996).

- Holland and Foo, B.Y. The British Accounting Review, Vol.35.118-23(2003).